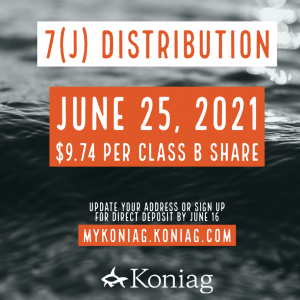

On June 25, 2021, Class B Shareholders are scheduled to receive a 7(j) distribution of $9.74 per share. Below are answers to some of the most common questions Koniag receives about the 7(j) distribution and their answers.

Why is my 7(j) distribution less this year?

The past year has been a challenging time for many business sectors. Oil and zinc prices, in particular, were impacted by the pandemic, which reduced the amount of resource revenue shared by other regional corporations.

The 7(j) reduction in no way reflects Koniag’s fiscal performance, which is continuing its record of long-term growth. Unlike the January Heritage dividend that comes from Koniag’s annual profits, the June 7(j) distribution comes from Alaska resource development revenue. Each of the 12 regional corporations—including Koniag—are required to share 70% of revenue generated from developing their ANCSA-conveyed lands with the other Alaska Native regional corporations. This ANCSA provision is often referred to as “revenue sharing” and is outlined in section 7(i) of ANCSA. Section 7(j) of ANCSA also requires each regional corporation to share 50% of the 7(i) funds they receive through revenue sharing with their in-region village corporations and “at-large” Shareholders.

Who is eligible to receive the June 7(j) distribution?

The Alaska Native Claims Settlement Act (ANCSA) defines which Shareholders receive the 7(j) distribution. The 7(j) distribution is issued to Shareholders who own Class B stock. Class B stock was issued to original Shareholders who were not enrolled in one of the ANCSA village corporations in the Koniag region. They are considered “At-Large” Shareholders. Class B stock was also issued to Natives of Kodiak Shareholders, as it is considered an ANCSA “urban” corporation. Natives enrolled to the village corporations of Karluk and Larsen Bay originally were issued Class A stock. Because Koniag merged with the village corporations of these two communities, the former Shareholders of these village corporations also received Class B stock in Koniag as part of the merger agreement.

Why is the 7(j) distribution taxable?

Federal law outlines how 7(j) funds must be distributed to Shareholders. Because the process for payment of these funds is outlined in Federal law, Koniag cannot contribute the funds to the Shareholder Settlement Trust. This means that the 7(j) distributions are taxable.